GOLD, WHAT NOW?

Posted Feb 16, 2016 by Martin Armstrong

QUESTION:

Hello Martin

Today it seemed as if you posted a basically bearish Euro call and a temporary bullish Gold call. I understand that a crisis in the Euro could get people to buy gold but in the long term if the Euro falls to 80 Cents, Gold in Dollar terms would drop to the $ 1,000 per ounce you have been predicting. Don’t the two calls conflict ?

Thanks

Confused.

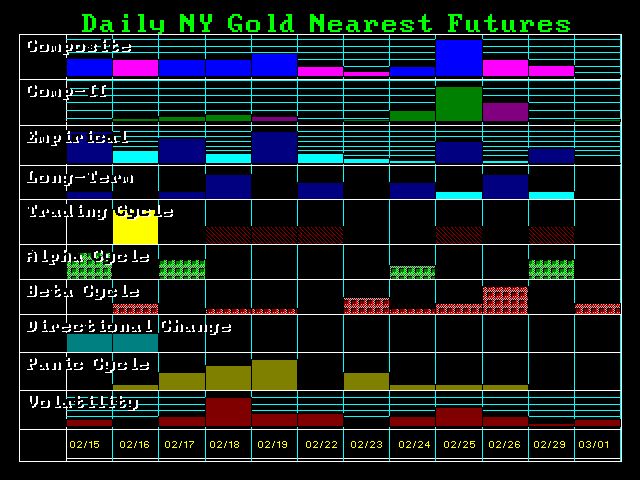

ANSWER: This is how it is set up on our model. But keep in mind, this is short-term swings, not yet long-term changes in trend. Our opening pivot point is 1211.77 for tomorrow. It is still pointing upward. When that turns down, typically so will trend. Keep in mind that a panic in Europe will still have a positive impact on gold. You may actually see the dollar, Dow and gold rise. Eventually, this will be the trend to emerge when capital realizes that it is not looking very good outside the USA with war brewing in the Middle East, Europe controlled by madmen/madwomen, and we will see the three link together briefly.

The second phase when people then turn on the USA, then gold would rise against the dollar. That trend is not yet here. For now, we are in the staging process. The relationships will be tested to their limits. So a gold rally is still possible in a crisis emerging in Europe. It may not last long-term.

We need a monthly closing in gold ABOVE 1363 and a Quarterly closing above 1309 before you can negate a potential collapse still below $1,000. We have central banks dumping gold to raise cash. So this is not over until the central bankers scream. Holding 1170 on a closing basis leaves gold still positive for now.

Categories: Uncategorized

Market Talk — February 16, 2016

Posted Feb 16, 2016 by Martin Armstrong

Read More

No comments:

Post a Comment